…The reality is that fossil fuels are not going away

…There has been energy transition since existence of humanity.

-Felix Douglas

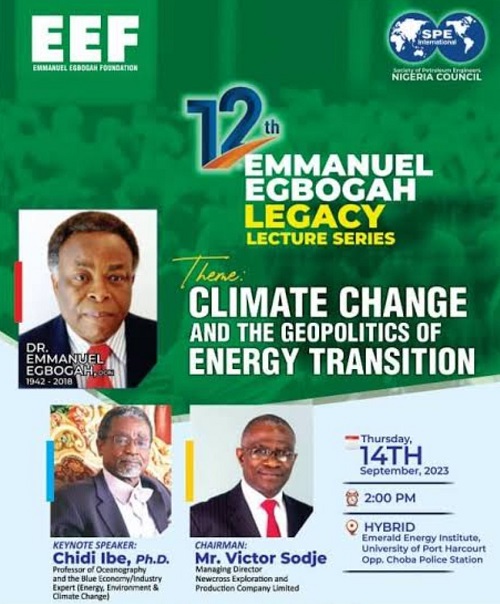

The 12th edition of Emmanuel Egbogah legacy series which was hosted by Emmanuel Egbogah Foundation (EEF), at Emerald Energy Institute (EEI) auditorium, University of Port Harcourt (Uniport), attracted industry players and the academia who attended the annual occasion. Notably among participants were Prof. Wumi Iledare, Executive Director of EEF, and Prof. Joseph Ajeinka, seventh Vice Chancellor of Uniport among others. The Society of Petroleum Engineers (SPE) was also a partner to the legacy lecture.

Speaking at the event, Professor of Oceanography, Prof. Chidi Ibe, who was the keynote speaker, said he met Dr. Egbogah in 1977 at the Royal School of Mines in Imperial College, as a student and he instructed him correctly as he proved his exploit around the world and the flames are still burning.

Giving his keynote address with the theme: Climate Change and the Geopolitics of Energy Transition, Prof. Ibe noted that there is a little doubt since the industrial era began in the 18th century and has gotten worse over the last few decades.

The year 2023 has recorded high temperatures in obscure places which mean the trend is continuing with other things such as sea surface temperatures and rising sea ice that is increasing, a testament to typical manifestations of global warming.

The Professor of Oceanography and industry expert in energy and climate change said the continued deletions of greenhouse gases have been responsible for continuous rise. Among the greenhouse gases emissions, fossil fuels have been fingered as the main culprit driving the warming trend.

Statistically, 80% contribution from fossil fuels, renewable energy meagerly 10% is rising, nuclear energy is 9%.

The changing patterns known as climate change brought by warming trend, have caused multifaceted impacts on natural environment, inducing extreme weather events which include accelerating sea level rise influencing water accessibility intensifying wild fires and provoking human displacement. The multiplier effects also led to conflicts arising from displacement and impact in travel and commuting trends.

In 2009, President Barack Obama in Copenhagen planet conference called climate change said, “The greatest challenge of our time” and that’s how serious the world takes the issue of climate change.

Continuing Prof. Ibe asserted that the infamous climate change derail ambitions of world leaders to sign a binding climate agreement in Copenhagen due to greenhouse gases. This was replicated after six years in Paris. The international climate negotiations continued and propelled by doomsday scenarios.

The Intergovernmental Panel on Climate Change (IPCC) reports that climate change was elevated for good reasons as it was argued is for existential threat. Fossil fuels which had been fingered as the main culprit slowly faced termination.

It was in these circumstances that the world leaders in Paris 2015 signed an agreement.

This paved a way for novel opportunities and challenges in face of energy development and agribusiness with the promise of a more conducive and sustainable world.

The most glaring of these adjustments encapsulated in the content of energy transition which culminated in achieving net zero is referred to by some as carbon neutral or climate neutral by 2050.

The IPCC had concluded in its assessment report issued in 2007, the need for zero Co2 by 2050 in order to remain consistent with 1.5 degree centigrade rise above pre industrial temperatures.

Consequently, this whole hullabaloo about energy transition, is it something new?

According to Prof. Ibe, “Since humanity came into its own through the discovery of the first source of energy, there has been an energy transition.”

The ongoing transition from wood to coal, petroleum or crude oil to natural gas, which is associated with crude oil, then nuclear energy to hydroelectricity and other renewables, there has been energy transition since the existence of humanity.

Recent energy transition was due to preference which was predicated on the ease of combustibility of fuel, ease of production and transportation.

Lessons from Ongoing Transition

Lessons from the ongoing transition which was inherited show that the move from one dominant fuel to the other, fuel that is substituted does not vanish. It fades gradually as the substituting fuel in the energy mix finds its way.

The lesson from coal to petroleum transition takes 50 to 60 years plus for it to take place. Only few producers that adopt best practices escaped the ensuing destabilization. The cheaper production costs show competitive over the other. Diversification of industry is a safety belt to any upheaval within the larger industry.

Decarbonisation is tied to future energy transition. In the first phase of energy transition despite pollution including its impacts on humans and environment, decarbonisation in the present energy transition was a distant consideration.

Purveyors of fossil fuels and governments supporting them were content literally in mining gold and smiled to the bank due to largesse.

When the need to decarbonize become an existential issue and a stampede towards net zero emissions, the world largely cannot do without fossil fuels by 2050?

Taking a cue from COP 26 in Glasgow which was hosted by the UK government and was first review since Paris 2015, this is obvious.

How did fossil fuel and other issues fair? Looking at coal for instance, everybody thought it will receive a death sentence in Glasgow but Indian, Australia, China, the big boys of coal use, played down pre-conference doomsday scenario.

The Glasgow conference ended with a tepid statement about tempering down the use of coal. However, on petroleum, the big boys of fossil fuels, pressure from petroleum producing giants, Saudi Arabia, UAE, and others including the United States backed by the International Oil Companies, (IOCs) resulted in playing down the stopping of unwarranted subsidies on oil and gas. Nothing happened.

On agriculture, which is responsible for 24% of global budget, taking a look at greenhouse gas emissions by economic sector, nothing significant was said about agriculture and its contribution in Glasgow. Why? The big boys of commercial agriculture which are industrialized countries, who own commercial agriculture regarded it as a lifeline, block attempt of discussing its contributions.

Concerning the issue of Carbon Capture Utilization and Storage (CCUS) which is the use of technologies that can reduce pressure on fossil fuels and achieve net zero emissions, technology is touted to be key answer in the last few years arriving at net zero despite target.

Prof. Ibe was of the view that it is possible to achieve efficiency in coal and natural gas generation using right technique and phenomenal savings in terms of squelch release of carbon dioxide. There is less to do in aspect of carbon capture and sequestration including direct air capture.

Thus, “Presently, there is a new technology that joins nuclear reactors with carbon dioxide emitting technologies in order to squelch Co2 emissions.

“Commencing on this advancement, Nenad Miljkovic, a Professor of Mechanical Science and Engineering at the University of Illinois at Urban Champaign in the US, who is the project lead, said “The reality is that fossil fuels are not going away. Fossil fuels are going nowhere for the next 100 years. This is the realities we know. A lot of Co2 will be emitted before we can lean on renewables.” Renewable is supposed to substitute but it will take a long while.

Again on energy transition, Germany, for instance which had been the apostle of green energy, established and expand new coal station in 2019 after the country has signed to kill coal. Norway also makes phenomenal amounts of money from the process of fossil fuels. This could be discovered from the country’s Sovereign Wealth Fund. They are involved in fossil fuels and showing no appetite to stop.

On its part, US opened bid rounds for new acreages for petroleum exploration which ExxonMobil and Chevron took advantage. There are also speculations that new bids will soon be in the Gulf of Mexico and it continues.

After hosting Glasgow in 2021, the UK is delaying its nuclear plants saying internal combustion engines at the beginning of next decade in 2030, but closure of coal plants is delayed.

Reacting to UK energy demands, in November 2022, Rishi Sunak approved establishment of a brand new coal mine. They are all foreseeing the future.

The Russia-Ukraine war brought panic to European Union countries. Faced with energy penury, they switch back to abundant sources of energy, such as coal, diesel and nuclear plants just to escape stranglehold of Russia and its geopolitical implications.

Reactor Panel

Shortly after the keynote address of Prof. Ibe, there was a reactor panel which was chaired by Prof. Adewale Dosumu to deliberate on the subject matter and also air views about the industry. He called the attention of participants of Egbogah legacy lecture that the IOCs are leaving Nigeria. The most recent being Agip, which has sold its asset to Oando, an indigenous company. Dosumu decried the meager amount of the asset sold to Oando shows the IOC was in a hurry to exit the country.

Showing her displeasure about the current trend of the petroleum industry in Nigeria, Engr. Oluwaseyi Afolabi, one of the invited guests, recalled as a young engineer that she did her intern with Eleme Petrochemical Company and it was entirely managed by Nigerians. So, what went wrong after many years and why couldn’t it be sustained?

Engr. Afolabi who worked 24 years with ExxonMobil said that the IOCs are concerned about return of investment. “Before the PIA, every dollar that an IOC would declare as profit in Nigeria 93 cents goes to the government. It takes 7 cents home.”

Moreso, several taxes, such as 85% BPT, 3% effective royalty, 2% education tax and Niger Delta Development Commission (NDDC) including a host of other deductions are paid. Who does business like that? The only reason why the IOCs have remained in Nigeria was because of the volume base. The reserves were huge enough when added to other reserves everywhere else in the world; it looks like a country with future. “ExxonMobil has found its way to Guyana and other IOCs have followed the same step. Hence everybody is going to Guyana and all the money is going to that country.”

Shell, Total and ExxonMobil have picked interest in Namibia because the fiscal terms are friendly. Nigeria operates business as if it is policing people.

Engr. Afolabi said since she retired and become an entrepreneur, she feels like being under siege from various tax bodies. It is quadruple taxation. “You have to pay federal, state and local governments, customs duties including 1% to Nigerian Content Development and Monitoring Board (NCDMB). One is forced to ask what are they doing with all the money?”

The reason for NCDMB funds is to help new entrepreneurs to grow their businesses but the money is kept in the banks and the purpose is still opaque.

In reality, the fiscal terms are not commensurate with the amount of investments for exploration. New frontiers are attractive for investors to invest.

Since young entrepreneurs and indigenous producers are taking part in the business, should they be stifled like the IOCs or allow them to operate?

“No pioneer status tax holiday, you start business today, all level of governments from federal, state and local want taxes from day one and no one can see vividly what is being done with the taxes. The citizens don’t understand and they are confused with the situation resorting to vandalization of pipelines hence they are involved in illegal oil theft.”

Engr. Afolabi urged young Nigerians to “Stop being pedestrian. Countries are advancing and going to space but in Nigeria we are pedestrian and involved in oil theft. Something that belongs to us, why are we stealing them?”

“When Nigerians go out of the country, they go there to prosper. They are the best brains around the world. The best doctors in the US and UK are Nigerians.”

She advised young Nigerians to stay at home and avoid the japa syndrome. “God in His infinite wisdom decided to make you a Nigerian.”

But in a swift reaction, Prof. Iledare, spoke on Petroleum Industry Act (PIA) fiscal framework since he was involved when it was still a bill.

According to Prof. Iledare: “I don’t think the divestment is really because of PIA, I think is more of security issues. Secondly, where the IOCs are going was where Nigeria was 60 years ago when the country gave multinational oil companies everything nearly for free. I can stand on my title as Professor Emeritus. I challenge all their economists to come and debate.”

“The PIA framework that we have today is at per with PSE 1993 in terms of net present value and internal rate of return. They allowed the PIA to be truncated.”

Although there are many regulations that are not necessarily part of PIA, which operators got by the agencies that has nothing to do with fiscal regime.

“I can agree that it has to do with governance that remains ineffective, inefficient, inequitable and unethical perhaps that is what is driving the IOCs out of the country not the fiscal term in the PIA.”

It has not yet been converted; the old fiscal term is still in place.

However, Namibia gave acreages the way Nigeria gave them to the IOCs when they first came to Nigeria. At present, Nigeria is matured.

Notwithstanding, the PIA is not perfect, but the imperfection was due to the IOCs. Yet, I still challenge the IOCs Petroleum Economists in any national broadcasting medium to show me what is wrong with the fiscal term. “The royalty is effective, less than 20% and the highest is 15% and effective royalty is 12.5%. They took Nigerian hydrocarbon tax from Deepwater and truncated fiscal rule of general application. Instead of three tranches in Deepwater, they lobbied and got two.

A Political Economists, said although Nigeria needs petroleum for the foreseeable future but the focus should also be in renewable energy. He said Nigeria petroleum industry is at lowest playing level and losing grip. The country should find new frontiers to attract young indigenous entrepreneurs and investors.

Dr. Victor Ekpeyong, Managing Director of Kenyon counselled the government on security and ensuring that pipeline vandalisation and oil theft are nipped in the bud so that the country can make progress while investors remain.

Comment here