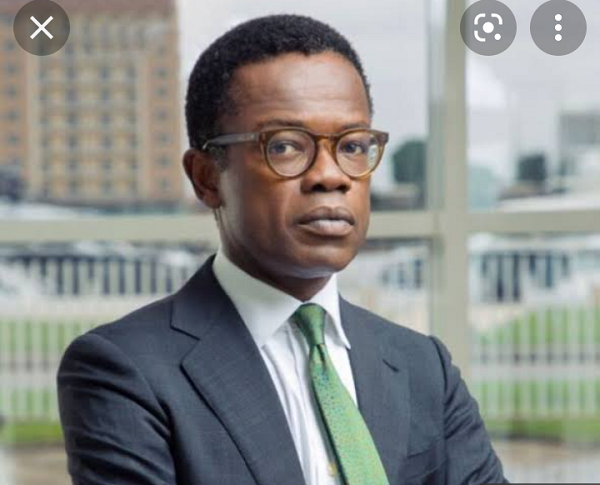

The Chief Executive Officer (CEO), of Ardova Group, a Nigerian integrated energy company, Mr. Olumide Adeosun, said the company’s capital investment in 2021 has been positively impacted on its balance sheet at the 43rd Annual General Meeting (AGM) of the company held on Tuesday in Lagos.

Ardova Plc had in November 2021 concluded the acquisition of Enyo Retail and Supply Limited (ERSL) as part of moves to increase its market share in the downstream oil and gas sector.

According to Adeosun, “Ardova continues a journey of growth and economic impact. Our shareholders are a major part of our vision to drive business expansion and transformation.

“We have ventured into partnerships in areas of our diversified investments resulting in capital projects that will deliver efficiency for the group.

“Our revenue growth is an attestation to the efforts and positive decisions made despite bearing economic challenges and we hope to continue to outperform market expectations with solid profit margins.”

He added that Ardova remains focused on a future beyond traditional fuels and taking necessary bold initiatives.

“By expanding our footprint across the nation through the acquisition of Enyo, we have widened the network of AP’s retail station outlets and shortened our proximity to the end customer.

“We have made it easier to deliver at wide scale retail the cleaner energy products that will materialise from our present capital investments,” Adeosun said.

Adeosun stated that Ardova remains committed to delivering shareholder value.

The energy trading company recorded a gross revenue of N192.47 billion in the 2021 financial year, representing a 5.95 per cent increase from the 2020 revenue of N181.66 billion.

Ardova Group also disclosed a revenue of N201.44 billion for 2021 which is a 10.71 per cent increase from 2020.

Its shareholders’ funds grew by 6.58 per cent year-on-year to N20.91 billion in 2021 financial year compared with N19.62 billion posted in 2020 due to 11.85 per cent growth in retained earnings.

The group also expanded its total asset base by 95.7 per cent year-on-year to N126.80 billion.

Adeosun also lauded the company’s 2021 performance and its strategy going forward.

Adeosun said: “Ardova continues a journey of growth and economic impact. Our shareholders are a major part of our vision to drive business expansion and transformation.

” We have ventured into partnerships in areas of our diversified investments resulting in capital projects that will deliver efficiency for the group.

“Our revenue growth is an attestation to the efforts and positive decisions made despite bearing economic challenges and we hope to continue to outperform market expectations with solid profit margins.”

He added that Ardova remains focused on a future beyond traditional fuels and taking necessary bold initiatives.

“By expanding our footprint across the nation through the acquisition of Enyo, we have widened the network of AP’s retail station outlets and shortened our proximity to the end customer.

“We have made it easier to deliver at wide scale retail the cleaner energy products that will materialise from our present capital investments,” he said.

Adeosun stated that Ardova remains committed to delivering shareholder value.

Mr. Moshood Olajide, Chief Financial Officer/Executive Director, Finance & Business Support, Ardova Plc, noted, that the increase in the group’s revenue was primarily driven by growth in the fuels business which constituted 86.7 per cent.

He said Lube sales recorded 52 per cent growth resulting in 12.8 per cent of revenue, the transport and logistics business constituting 0.3 per cent, and Liquefied Petroleum Gas Cylinder sales with 0.2 per cent of the group revenue.

Comment here